Although demand remained subdued in mature battery markets like Germany and Italy during the first six months, other European countries saw strong growth. Austria, France, the Netherlands, and the Czech Republic all recorded significant increases. One key driver of photovoltaic home storage expansion is falling prices. EUPD Research reports an average selling price of €711 per kilowatt hour for home storage systems in the first half of 2025.

Demand for battery storage systems for private households with a capacity of up to 20 kilowatt hours remained stable in Europe in the first half of 2025. However, the picture varies across countries. Mature markets like Germany and Italy saw subdued demand. In contrast, other countries recorded considerable growth. This is according to the latest Electrical Energy Storage (EES) Report Europe H1 2025, published by EUPD Research on Wednesday.

Analysts expect homeowners across Europe to install more than one million photovoltaic home storage systems in 2025. Demand is likely to rise further in the second half of the year. EUPD Research notes that growing interest in dynamic electricity tariffs and increased self-consumption will continue to drive this trend.

The continued decline in battery prices is also a driving factor.

The price decline accelerated over the past two years due to increased competitive pressure. EUPD Research’s Price and Inventory Tracker shows a sharp drop in prices for private storage systems up to 20 kilowatt hours in Germany. Between the first half of 2023 and the first half of 2025, the price index fell by more than 50 percent. The average selling price dropped from €1,332 to €711 per kilowatt hour during this period.

In Europe, Germany remains the undisputed leader, despite a slight decline in new installations in the first half of 2025. The six percent year-on-year drop resulted from fewer rooftop photovoltaic installations, reduced regional incentives, and a growing shift toward commercial and industrial storage, EUPD Research explained.

However, analysts still expect Germany and Italy to lead in new home photovoltaic storage installations in Europe by 2028. Demand in Italy has also weakened due to the expiration of its subsidy program.

Markets in Austria, France, the Netherlands, and the Czech Republic continue to grow steadily. Stable policy support and rising awareness of energy independence are key drivers.

In the Netherlands, a combination of dynamic tariffs, widespread smart meter adoption, and VAT exemptions for photovoltaic systems and home storage has boosted demand. Sweden has seen a record number of new photovoltaic systems with home storage, driven by generous tax rebates. Meanwhile, in France, the upcoming end of the Access to Historic Nuclear Power (ARENH) mechanism on December 31, 2025, is expected to further strengthen incentives for self-consumption. As market-based electricity tariffs for residential customers rise and become more volatile, EUPD Research highlights growing interest in energy independence.

For the coming years, analysts expect Austria and the United Kingdom to “lead the next wave of home storage expansion.” However, given the continuing decline in storage prices, continued growth is expected in Europe as a whole.

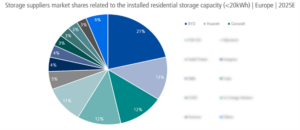

The European home storage market is highly competitive among manufacturers. According to surveys by EUPD Research, BYD maintained its leading position in Europe in 2024 with a market share of around 20 percent, which is expected to increase to 21 percent this year. Several other manufacturers have recently gained market share in Europe, including Huawei, Growatt, Fox ESS, Pylontech, and Goodwe. Several German manufacturers, including E3/DC, Sonnen, Fenecon, and Varta Storage, have firmly established themselves in the market.